Note that dividends are distributed or paid only to shares of stock that are outstanding. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares. Regardless of the type of dividend, the declaration always causes a decrease in the retained earnings account. tax software survey Companies can issue different types of capital stock each of which carries different rights mainly relating to dividends, and voting. The two types of capital stock usually issued are common stock, and preferred stock. The company needs to spend cash to purchase these kinds of investments.

Dividend received on the investment in shares of another company

The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. The company usually records the purchase of the treasury stocks first before deciding whether to resell them or retire them later. Again, the number of shares will not be reflected anywhere in the accounting system. Currently, only actual journals (purchases, sales, credit notes, cheques, deposits, transfers, etc.) are recorded in the system. Reports like Trial Balance and Balance sheet work out Opening Balances, Retained Earnings, Net income for the year on the fly by summing appropriate journal records. A purchase of own shares, also known as a share buyback, may have tax advantages for a shareholder who wants to reduce or end their shareholding in a company.

Accounting Education

ACCA’s technical factsheet, Company purchase of own shares, includes accounting treatment along with journal entries for all the methods discussed above. Additionally, it provides detailed guidance for legal and taxation aspects, template resolutions. Finally, Appendices 5 and 6 summarise the procedure for obtaining advance clearance from HMRC before any deliberations are concluded. It’s vital that all your transactions are entered properly so that your books can be well balanced. QuickBooks Desktop is a great software able to help you keep track of assets, liability, and equity of your business to see the financials of your company.

Cash Dividends

- This capital is used by the company to fund operations, invest in assets, and pay salaries.

- If there is no balance in the Additional Paid-in Capital from Treasury Stock account, the entire debit will reduce retained earnings.

- Both small and large stock dividends occur when a company distributes additional shares of stock to existing stockholders.

- Similar to distribution of a small dividend, the amounts within the accounts are shifted from the earned capital account (Retained Earnings) to the contributed capital account (Common Stock) though in different amounts.

Prior to the distribution, the company had 60,000 shares outstanding. The difference is the 3,000 additional shares of the stock dividend distribution. The company still has the same total value of assets, so its value does not change at the time a stock distribution occurs. The increase in the number of outstanding shares does not dilute the value of the shares held by the existing shareholders. The market value of the original shares plus the newly issued shares is the same as the market value of the original shares before the stock dividend.

Typical Common Stock Transactions

As such, although the number of outstanding shares and the price change, the total market value remains constant. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. The total value of the candy does not increase just because there are more pieces. Stock can be issued in exchange for cash, property, or servicesprovided to the corporation. For example, an investor could give adelivery truck in exchange for a company’s stock.

The general rule is to recognize the assets received in exchange for stock at the asset’s fair market value. In this case, we can make the journal entry for the $200,000 investment in shares of the ABC corporation by debiting this $200,000 to the stock investment account and crediting the same amount to the cash account. As mentioned, we may receive the cash dividend from the investment in shares that we have made in another company. And such dividends may need to be recorded as the dividend revenue or as the reduction of the stock investment. In this journal entry, the stock investment account is an asset account on the balance sheet, in which its normal balance is on the debit side. This stock investment can be a long-term asset or a short-term asset based on the purpose of the shares investment that we have made in another company.

CCC does not own sufficient shares to control the operations of CCE but it certainly can apply significant influence if it so chooses. So instead of putting the cash in the bank, they use it to invest in the other companies for higher profit. The subsequent distribution will reduce the Common Stock Dividends Distributable account with a debit and increase the Common Stock account with a credit for the $9,000. While a few companies may use a temporary account, Dividends Declared, rather than Retained Earnings, most companies debit Retained Earnings directly.

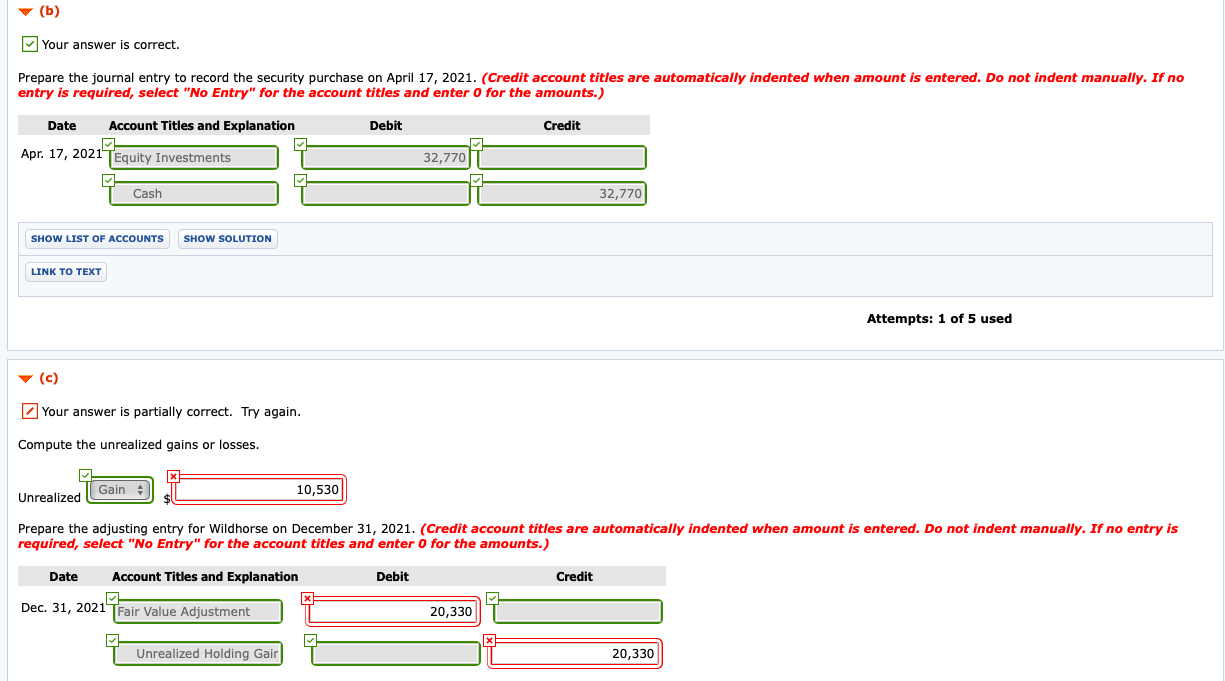

The gain here is labeled as “unrealized” to indicate that the value of the asset has appreciated but no final sale has yet taken place. The gain is not guaranteed; the value might go back down before the shares are sold. However, the unrealized gain is recognized and reported on the owner’s Year One income statement.

In this journal entry, the par value or stated value of the stock, as well as the original issued price, is not included with recording the purchase of the treasury stock. Sometimes a corporation decides to purchase its own stock in themarket. A companymight purchase its own outstanding stock for a number of possiblereasons.

Second, the company must have sufficient retained earnings; that is, it must have enough residual assets to cover the dividend such that the Retained Earnings account does not become a negative (debit) amount upon declaration. On the day the board of directors votes to declare a cash dividend, a journal entry is required to record the declaration as a liability. When a company issues new stock for cash, assets increase with a debit, and equity accounts increase with a credit.